INTRODUCTION

The growing popularity of alternative and emerging tobacco products (ATPs)1,2 has resulted in expansion of the tobacco industry along with increased political activity aimed at defeating new state and federal tobacco control legislation3,4. Tobacco industry actors now comprise a diverse group of stakeholders, including large multinational tobacco companies that manufacture and sell ATPs, brick-and-mortar ‘vape’ shops that serve specific communities of ATP users, chain convenience and ‘big box’ retailers that sell a variety of conventional tobacco and ATP products, trade associations that mobilize and promote industry interests, and online ATP vendors that market and sell through digital channels5-7. Critically, all of these actors have a financial interest in limiting success of future ATP product regulation, including policies that tax, restrict use, or ban sales of certain ATP products (e.g. state and federal sales bans on flavored vaping products)8,9.

Increased industry opposition to tobacco control policies come as signs that ATP sales are slowing, accentuating the importance of federal policy actions [including the U.S. Food and Drug Administration (FDA)’s 2016 Final Rule10 that extends its regulatory authority to all tobacco products and based on health risks arising from the act of combustion, not nicotine]. Regulators have also signaled increased attention to ATPs outside of formal federal legislation. For example, in September 2018, the FDA announced that Juul and four other ATP companies would need to ‘convincingly address’ that their products do not target minors, subsequently in June 2022, issued a marketing denial order requiring the removal and suspension of sale of JUUL products. Leading early implementation of progressive tobacco and ATP control policies have also been state legislatures, which have passed laws and referendums restricting sales to underage persons, imposing licensure requirements, restricting use of ATPs in private and public settings, and imposing tobacco/e-cigarette taxes in order to reduce appeal and uptake12.

In response to this increased tobacco control policy activity, the ATP industry has become aggressive in mobilizing opposition to these efforts using its expansive network of manufacturers, trade associations, tobacco user communities, and appealing to the general public, in order to directly influence public perception against tobacco control laws13 and to advocate for ‘vaper rights’14. This includes traditional means of political lobbying by multinational tobacco companies and retail trade groups, who spend millions of dollars on public relations campaigns and lobbying to defeat legislation15,16. The tobacco industry also engages in grass roots advocacy by mobilizing vaping shops and owners, along with user constituent communities via online and social media campaigns17-19. Importantly, the overall rise in popularity of ATPs over the past decade has led to an increase in specialized vaping retail outlets, which carry out their own forms of mobilization, advocacy, and influence, distinct from efforts of big tobacco firms20,21.

At the forefront of this battle over the future of US tobacco control policy is the state of California, which has enacted a number of progressive anti-tobacco policies through state legislation and public referendum. Specifically, the California Healthcare, Research and Prevention Tobacco Tax Act (Proposition 56)22 was a crucial ballot measure that passed with 64.43% public support in November 2016, increasing the cigarette tax by $2.00 per pack ($0.87 to $2.87 per pack), with equivalent increases on ATPs, and went into effect on 1 April 2017. Despite the success of Proposition 56, past ballot initiatives to raise state tobacco taxes, such as 2012 CA proposition 29 ‘the Tobacco Tax for Cancer Research Fund Initiative’, had failed, necessitating an in-depth assessment of how tobacco industry actors have both succeeded and been thwarted in their efforts to defeat these measures.

However, only a few studies have specifically examined strategies used by industry aimed to defeat recent state-based legislation using data from sources such as the Internet, social media, or voting records23-27. Hence, this study examines the potential association between the proportion of people voting against Proposition 56 and tobacco/ATP retail density in California, stratified by store type (e.g. general non-specific retailers vs tobacco/ATP specialized retailers), and for time frames before, during, and after the passage of Proposition 56. This study also assesses if the proportion voting against Proposition 56 is a significant predictor of change in non-specific and specialized retail density between years 2016 and 2019, while controlling for sociodemographic factors such as age distribution, race/ethnicity, and median household income. The primary aim of the study was to identify if counties with high density of tobacco or specialty vaping store fronts impacted voting patterns on Proposition 56.

METHODS

Data collection

Licensed tobacco retailer listings from 2015–2019 were obtained from the California Department of Tax and Fee Administration (CDTFA) publicly available database28. This listing provides information on tobacco and ATP retailers legally licensed to operate in the state and includes: 1) owner name; 2) doing business as (‘DBA’) name; 3) license number; 4) store address; 5) license commencement date; and 6) license expiry date. Importantly, the CDTFA listing does not provide a detailed categorization of the type of store (non-specific vs tobacco/ATP specialized) of each licensee. In order to assess the store type, license data obtained from CDTFA were cross-referenced with data available from crowd-sourced business listing website Yelp, matched to store names and addresses using the computer programming language Python. Businesses listed on Yelp are automatically assigned or labelled by business owners to one of the various business categories available, which include subcategories for vape, tobacco, and head retailers/shops. Using this data, CDTFA licensed retailers were matched and classified into two categories: 1) specialized stores (stores labelled as tobacco and/or vape stores), and 2) non-specific stores (general retailers, convenience stores etc., that are licensed to sell tobacco and/or vape products but are not specialty tobacco/ATP stores).

In addition to matching licensees for store type, geographical data – including the latitude and longitude for each retailer address – was obtained using the Microsoft Bing API (Application Programming Interface). For voting data, the proportion voting for or against Proposition 56 and the proportion of registered voters (including a breakdown of those identifying as Democrat, Republican, Independent or other) was obtained from the California Secretary of State’s website29. County-level population and demographic data for 2015–2019 were obtained from the American Community Survey including proportion of age groups, gender, race/ethnicity and median household income. Separate variables were obtained for twelve age groups (<5, 5–9, 10–14, 15–19, 20–24, 25–34, 35–44, 45–54, 55–64, 65–74, 75–84, >84 years) and eight race/ethnicity categories (White, Black, American Indian or Alaska Native, Asian, Native Hawaiian or Pacific Islander, Hispanic, Other, and Multi-Race).

Statistical analysis and geospatial visualization

A total of 26370 tobacco retailer licenses were cross-referenced using Yelp for store categorization. Tobacco retail density (total active licenses and new licenses) for each year from 2015–2019 was calculated based on the dates of license commencement and expiration provided on the CDTFA database. In order to obtain the retail density for each county within California, the point coordinates (latitude and longitude) for each storefront were plotted on a California base map using ArcGIS v10.7.1 (Esri: Redlands, CA) and further aggregated to obtain county-specific retail density of non-specific and specialized tobacco and/or vape storefronts for each year from 2015 to 2019, inclusive. The point coordinates were further aggregated to obtain the county-specific total number of retailers under each store category for 2015–2019.

The retailer density data at the county level for each year was exported to statistical software to explore the association between tobacco retail density and proportion voting against Proposition 56. A series of linear regression models was used to assess for significant associations between tobacco retail density for each year and proportion voting against Proposition 56 and if the association varied between non-specific tobacco retail density and specialized tobacco and/or vape retail density. County population was included in the model to normalize store count. Linear regression was also used to examine any significant association between change in tobacco retail density (non-specific and specialized) from 2016 to 2018 and proportion voting against Proposition 56. Further, an adjusted linear regression model with backward selection was used to identify other significant predictors of retail density. Covariates in the backward selection model included age groups, gender, race/ethnicity and median household income.

All statistical analyses were conducted using SPSS version 27. A p=0.10 was used for backward selection criteria and p<0.05 was considered statistically significant for all other analyses.

RESULTS

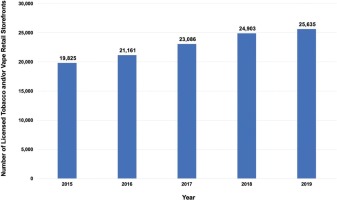

A total of 31251 retailers were licensed to sell tobacco and/or ATPs at any point between 2015 and 2019 in California per the CDFTA listing, out of which 26370 (84.38%) matched and were cross-referenced using Yelp. The total number of active licenses was 19825 in 2015, 21161 in 2016 (6.7% increase from prior year), 23086 in 2017 (9.1% increase), 24903 in 2018 (7.9% increase), and 25635 in the year 2019 (2.9% increase), representing an overall increase of 29.31% from 2015 to 2019 (Figure 1). Of the stores that matched to Yelp categories, 91.37% (n=24093) were non-specific tobacco retailers and 8.63% (n=2277) were specialized stores (tobacco stores=994, vape stores=549, stores selling both tobacco and vape=734). Many of the non-specific tobacco retailers were chain retail outlets (e.g. grocery stores, gas stations, big-box retailers).

Figure 1

Total number of active licenses for tobacco and/or vape retail storefronts in California from 2015 to 2019

For voting proportion for Proposition 56, overall, 13.92 million (13919782) Californians cast a vote for the ballot measure, representing 76.97% of the registered voters or 18.05 million (18084999). Voters comprised of 45.10% Democrat (n=8155831), 27.09% Republican (n=4898389), 2.52% Independent (n=454946) and 25.30% other (n=4575833). San Francisco County had the highest proportion of voters registered as Democrat (58.31%) and Modoc County had the highest proportion of voters registered as Republican (50.97%). The highest voting proportion against Proposition 56 was observed in the far northeast Modoc County (63.00%), which also had the highest proportion of voters registered as Republican (50.97%) and is the third-least populous county in the state. The lowest voting proportion against Proposition 56 was observed in the northern Yolo County (10.94%), which had only 22.12% of voters registered as Republican and is included in the Greater Sacramento metropolitan area.

Overall, we observed that the distribution of those voting for and against Proposition 56 appeared to be skewed based on party affiliation (i.e. Democrats in favor, Republicans opposed). A statistically significant positive correlation was observed between proportion of voters registered as Democrats and proportion voting in favor of Proposition 56 (rho=0.891, p<0.001) and a statistically significant inverse correlation was observed between proportion of voters registered as Republicans and proportion voting in favor of Proposition 56 (rho= -0.879, p<0.001) at the county level.

Linear regression models demonstrated that the proportion voting against Proposition 56 was a statistically significant positive predictor of population-normalized non-specific tobacco retail density for each of the years within 2016–2019, inclusive, but not for 2015 (the year prior to passage of the Proposition) (Table 1). Proportion voting against Proposition 56 was also a significant positive predictor of specialized tobacco and/or vape retail density, but only for the subsequent years following ballot approval and after implementation of the tax increase (2018 and 2019). Hence, voting districts with higher retail density of non-specific tobacco stores was predictive of voting against Proposition 56 in the year of the referendum, though areas with higher specialized retail density were only predictive based on retail density following passage of the referendum. There was no significant association between proportion voting against Proposition 56 and specialized tobacco and/or vape retail density for 2015–2017, after normalizing for store count using county population.

Table 1

Proportion voting against Proposition 56 and tobacco retail store density (non-specifica and specializedb) at the county level, California (2015–2019)

| Year | Covariate | Specialized tobacco and/or vape storefrontsb | Non-specific storefrontsa | ||||

|---|---|---|---|---|---|---|---|

| β (95% CI) | S.E. | p | β (95% CI) | S.E. | p | ||

| 2015 | Proportion of people voting against Proposition 56 | 0.03 (-0.09–0.15) | 0.06 | 0.42 | 0.83 (-0.24–1.90) | 0.53 | 0.13 |

| County population | 2.63 (2.53–2.73) | 0.05 | <0.001 | 45.89 (45.05–46.73) | 0.99 | <0.001 | |

| 2016 | Proportion of people voting against Proposition 56 | 0.05 (-0.10–0.20) | 0.07 | 0.47 | 1.25 (0.02–2.47) | 0.61 | 0.046 |

| County population | 3.29 (3.18–3.41) | 0.06 | <0.001 | 48.19 (47.24–49.15) | 0.48 | <0.001 | |

| 2017 | Proportion of people voting against Proposition 56 | 0.13 (-0.06–0.31) | 0.09 | 0.18 | 1.57 (0.23–2.90) | 0.67 | 0.02 |

| County population | 4.27 (4.13–4.42) | 0.07 | <0.001 | 51.33 (50.29–52.37) | 0.52 | <0.001 | |

| 2018 | Proportion of people voting against Proposition 56 | 0.27 (0.03–0.50) | 0.12 | 0.03 | 1.83 (0.35–3.31) | 0.74 | 0.02 |

| County population | 5.35 (5.17–5.53) | 0.09 | <0.001 | 54.71 (53.56–55.85) | 0.57 | <0.001 | |

| 2019 | Proportion of people voting against Proposition 56 | 0.39 (0.10–0.67) | 0.14 | 0.009 | 1.91 (0.33–3.49) | 0.79 | 0.02 |

| County population | 6.41 (6.19–6.63) | 0.11 | <0.001 | 57.68 (56.45–58.89) | 0.61 | <0.001 | |

After adjusting for population, proportion voting against Proposition 56 was also a significant predictor of an increase in the total number of non-specific (proportion voting against Proposition 56: β=0.48, p=0.008) as well as specialized tobacco and/or vape retail storefronts (proportion voting against Proposition 56: β=0.21, p=0.001) from 2016 to 2018. Hence, areas in the state that had a higher proportion of the voting public in opposition to Proposition 56, experienced subsequent increases in the number of both non-specific and specialized tobacco and vaping storefronts, suggesting that pro-tobacco/ATP voter sentiment may also be related to tobacco and ATP product demand and consumption. Proportion voting against Proposition 56 at the county-level was overlaid and visualized on a choropleth gradient to illustrate change in total tobacco storefronts from 2016 to 2018 (Figure 2).

Figure 2

Proportional symbols for county-level percent voting against Proposition 56 overlaid on a choropleth gradient for change in total tobacco storefronts from 2016 to 2018

In the multiple linear regression model, proportion voting against Proposition 56 was a significant predictor of non-specific tobacco retail density for 2016–2019 after adjusting for covariates (Table 2). However, a significant inverse association between proportion voting against Proposition 56 and non-specific tobacco retail density was observed in contrast to unadjusted models for 2016–2019, in which a direct association was observed. The other significant covariates in the model included proportion of people in the age groups 25–34 years, 45–54 years, proportion of White and Asian population for 2017–2019, along with female proportion and proportion of those aged 15–19 years for 2016. There was no significant association between proportion voting against Proposition 56 and specialized tobacco and/or vape retail density for any of the years after adjusting for covariates. Also, there was no significant association between proportion voting against Proposition 56 and change in tobacco retail density (non-specific and specialized) from 2016 to 2018 after adjusting for covariates.

Table 2

Proportion voting against Proposition 56 and change in non-specifica tobacco retail store density at the county level, California, controlling for covariates (2016–2019)

DISCUSSION

From 2015 to 2019, there was an overall growth in the number of licensed tobacco retailers in California, a time that coincided with the introduction, passage, and implementation of Proposition 56. Generally, counties with more opposition to Proposition 56 had a larger number of tobacco retailers per capita. This association held true for generic, non-specialized retailers (i.e. those stores not specific to the marketing and sale of ATPs) during the vote for Proposition 56 (2016), during implementation of Proposition 56 (2017), and after Proposition 56 was implemented (2017 and 2018), but not before the passage of Proposition 56 (2015). Similarly, this association was true for specialized tobacco/ATP retailers but only after implementation of Proposition 56 (2018 and 2019). Therefore, in unadjusted models, the longitudinal discrepancy in these associations suggests that after passage of Proposition 56, areas with higher density of tobacco retailers also harbored communities that were in greater opposition to Proposition 56 or voting constituents with characteristics in greater opposition to tobacco/ATPs (e.g. Democratic affiliation, etc.). This indicates that party affiliation and registration heavily impacted support and opposition to Proposition 56, recognizing that overall, there is a higher proportion of CA voters who are registered as Democrat.

Our finding that opposition was also a predictor for an increase in tobacco store density (2016–2018) also reflects this potential association.

However, after adjusting for covariates of race and age, the association between opposition to Proposition 56 and tobacco retailers reversed for years 2017, 2018, and 2019. For each of these models, density of White Americans exhibited a positive relationship with store density, density of Asian Americans exhibited a negative association, density of people aged 25–34 years exhibited a positive association, and density of people aged 45–54 years exhibited a negative association. Associations with these race and age groups roughly correspond to known patterns in use of both e-cigarettes and combustibles (e.g. young adult populations have a higher prevalence of vaping use)30,31 as well as voting demographics (e.g. more White Americans registered as Republicans)32. These results indicate that other political and demographic covariates may be driving associations between voting proportion and different levels of tobacco retailer density, necessitating further exploration.

Results from our multivariate analysis also suggest that increases in the number of tobacco retailers in areas opposing Proposition 56 could be driven by changes in the differential density of specific demographic groups, such as younger White Californian residents. For example, in the study timeframe, population growth in California has started to skew towards more rural areas, with these communities historically being more conservative in makeup33. While these counties were generally in opposition to Proposition 56 in 2016, rapid changes in demographics (age and race) or internal migration within the state may ameliorate lack of support of tobacco control measures in future elections in these traditionally pro-tobacco areas. Hence, future policy making, public relations, and advocacy activity in support of tobacco control policy should target counties and voting districts where this demographic shift is occurring and also concentrate industry counter-marketing activities to areas traditionally at the tipping point of opposition and support influenced by these demographic changes.

A lack of association in 2015 for all models, and in 2016 for the adjusted modeling, suggests that the direction of association originates from legislative implementation to the presence of licensed local retailers. This suggests that attempts from the tobacco industry to exert influence on ballot referendums are more likely to be effective if it continues to bolster support from constituents where general tobacco retail density is heavy and by partnering with retail industry trade groups who generally oppose any restrictions on business and retail activity, versus visible electioneering directly from specialty retailers. This is further supported by the lack of associations observed with stores whose specific line of business is the sale of tobacco or ATPs, though Proposition 56 covered both combustible and ATPs.

Further, despite passage of Proposition 56, whose policy intent was to curb appeal of tobacco/ATPs by raising costs, we nevertheless observed an increase in licensed retailers and retail density in certain areas (including where a high proportion of the voting public was in opposition to Proposition 56). This may indicate that despite the plurality of voters in California that support tobacco control approaches, the disincentives created by Proposition 56 may have been insufficient to counteract general increases in demand and use of tobacco/ATPs during the study period.

Limitations

This study has certain limitations that limit our ability to confirm associations observed regarding the relationships between Proposition 56 support and the density of tobacco/ATP retailers. First, this study relies on spatial density of tobacco retailers as a proxy for local influence and possible voting patterns, although variation in retailer political participation and their tobacco and ATP user constituents is likely. This study did not include individuals (sole proprietors, husband and wife co-owners, and domestic partners) who are registered with, or hold licenses or permits issued by the CDTFA, per Civil Code Sect. 1798.69(a) of the Information Practices Act. Furthermore, we relied on categorization of retailers using the Yelp platform in absence of other available data. Although Yelp makes an effort to verify these store categories34, the accuracy of this verification is unclear in relation to stores that may also market and sell other non-tobacco and ATP products but may be labelled as specialized stores. Additionally, the ecological nature of the study cannot attribute direct associations of causality and the results cannot be generalizable to individuals.

CONCLUSIONS

The results of this study are exploratory and further research is needed to better understand the dynamics between voting patterns, retail store density, and the impact of tobacco control-related state propositions on overall tobacco/ATP uptake and use. Future studies should focus on investigating the role of tobacco/ATP storefronts on variation in local support or opposition for state tobacco control initiatives, especially with the aim of identifying differences in the effectiveness of industry-driven activities of local electioneering versus traditional forms of lobbying and industry influence.